Escrow

The Escrow section in xApp is where you manage the vesting of your escrowed XFI (esXFI). Vesting is the process of gradually unlocking your esXFI tokens, converting them into fully liquid XFI and depositing them into your wallet.

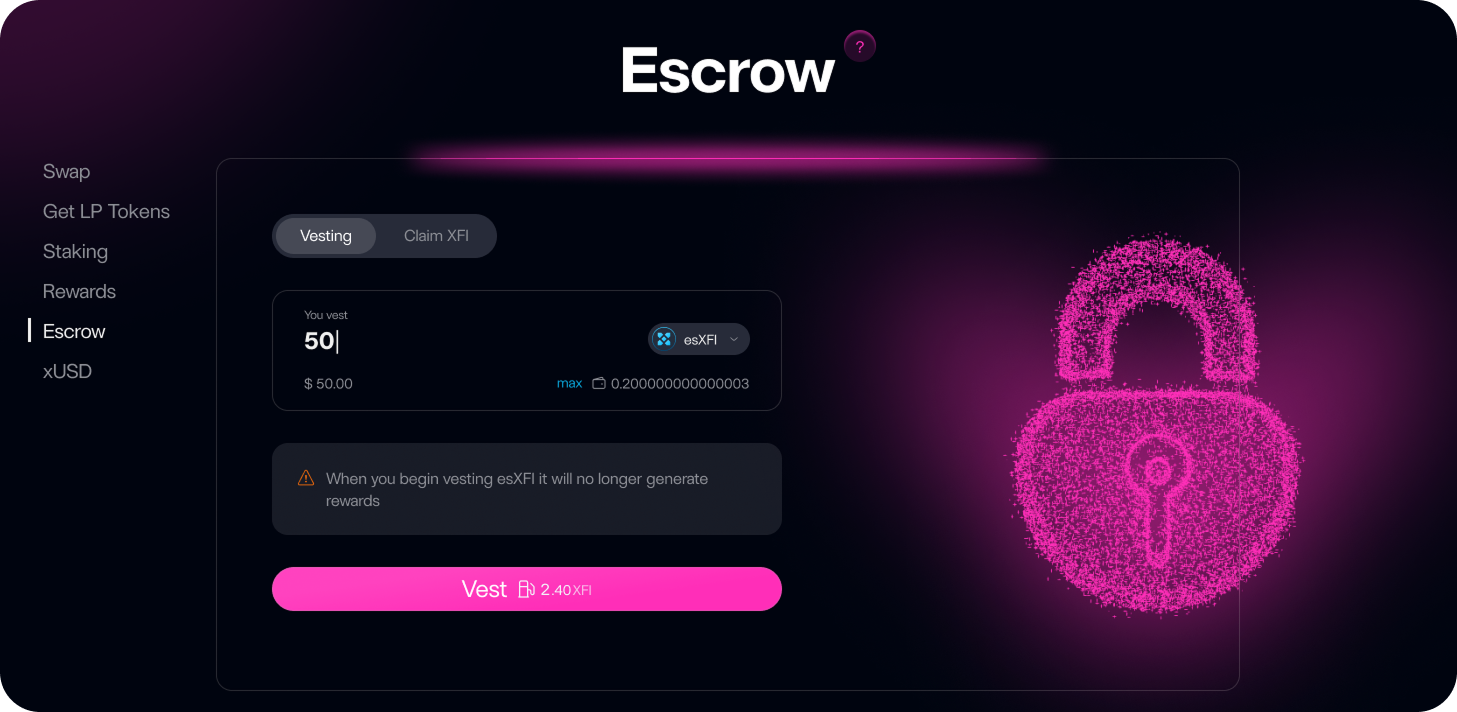

CrossFi xApp Escrow - Manage vesting of escrowed XFI tokens

CrossFi xApp Escrow - Manage vesting of escrowed XFI tokens

This system allows you to increase your overall yield without withdrawing your LP stake, creating a balanced approach between immediate liquidity needs and long-term earning optimization.

Understanding the Vesting System

- 🔒 What is esXFI?

- ⏰ Vesting Process

- ⚠️ Important Trade-off

esXFI (escrowed XFI) are rewards earned from staking LP tokens that are temporarily locked. They represent future XFI that will become liquid through the vesting process.

Vesting is the gradual conversion of esXFI into spendable XFI over time. The protocol uses a linear schedule (~6 months) to release your tokens steadily.

Once you begin vesting esXFI, that portion stops generating additional staking rewards. This creates a strategic decision between immediate liquidity and continued earning.

Vesting vs. Continued Earning

| Strategy | Benefits | Trade-offs |

|---|---|---|

| Keep as esXFI | Continues earning rewards + BP | No immediate liquidity access |

| Begin Vesting | Gradual XFI unlocking + eventual full liquidity | Stops earning on vested amount |

| Partial Vesting | Balanced approach | Some earning loss, some liquidity gain |

Consider your liquidity needs and earning goals when deciding how much esXFI to vest. You can always vest more later, but you cannot "un-vest" tokens already in the vesting process.

How to Vest esXFI

Navigate to Vesting

Go to Escrow → Vesting tab in xApp to view your available esXFI balance and vesting options.

⚠️ Important: Once you begin vesting esXFI, that portion will no longer generate additional esXFI rewards or contribute to your Bonus Points accumulation.

How to Claim Unlocked XFI

Switch to Claim Mode

Navigate to Escrow → Claim XFI tab to view your available unlocked XFI balance.

Monitoring Your Vesting Status

The Escrow dashboard provides comprehensive tracking of your vesting progress:

| Metric | Description |

|---|---|

| Total esXFI Vesting | Amount of esXFI currently locked in the vesting contract |

| Unlocked XFI | XFI that has completed vesting and is ready for claim |

| Vesting Period Remaining | Time left until your last esXFI tranche is fully unlocked |

| Completion Percentage | Progress indicator showing how much of your esXFI has vested |

| Daily Unlock Rate | Amount of XFI that becomes available each day |

All vesting metrics update in real-time, allowing you to track your progress and plan your claiming strategy effectively.

Vesting Strategies

Conservative Approach

- Vest Immediately: Convert all esXFI to vesting for guaranteed future liquidity

- Regular Claims: Claim unlocked XFI frequently to maintain liquid reserves

- Use Case: Risk-averse users who prioritize liquidity over maximum yield

Aggressive Approach

- Minimize Vesting: Keep most esXFI earning to maximize BP accumulation

- Strategic Timing: Only vest when you need liquidity for specific purposes

- Use Case: Yield maximalists focused on long-term compounding

Balanced Approach

- Partial Vesting: Vest 30-50% of esXFI for liquidity needs

- Flexible Claims: Claim as needed based on market conditions

- Use Case: Most users seeking balanced risk-reward profile

Impact of LP Staking on Vesting

| LP Status | Vesting Effect |

|---|---|

| Actively Staking | Normal vesting speed + continued esXFI earning on unvested balance |

| Partially Unstaked | Reduced vesting speed + proportionally reduced earning |

| Fully Unstaked | Significantly slower vesting + no new esXFI earning |

Maintain some LP staking position to keep your vesting rate optimal while still having access to partial liquidity through the vesting system.

Frequently Asked Questions

| Question | Answer |

|---|---|

| Can I vest only part of my esXFI? | Yes — you choose any amount up to your current esXFI balance. Remaining esXFI continues earning rewards until you decide to vest it. |

| What happens if I unstake LP while vesting? | Existing vesting continues uninterrupted, but the vesting rate may slow down. New esXFI earning will stop or reduce significantly. |

| Is there a minimum vesting period? | Yes — the protocol enforces a linear vesting schedule (typically ~6 months). The exact timeframe is displayed in your vesting status. |

| Can I cancel vesting once started? | No — vesting is irreversible. Once esXFI enters vesting, it cannot return to earning status. Plan your vesting decisions carefully. |

| How often can I claim unlocked XFI? | Anytime! There's no minimum threshold or maximum frequency for claiming your unlocked XFI. |

Advanced Vesting Tactics

Dollar-Cost Averaging

- Staggered Vesting: Vest small amounts regularly instead of large lump sums

- Market Timing: Increase vesting during bull markets, decrease during bear markets

- Benefit: Reduces timing risk and provides steady liquidity flow

Liquidity Planning

- Anticipate Needs: Vest esXFI 3-6 months before you need the liquidity

- Emergency Reserve: Keep 10-20% of esXFI in vesting for unexpected needs

- Reinvestment Ready: Plan claims to coincide with good market entry points

Tax Optimization

- Timing Claims: Coordinate claims with tax year planning

- Staged Realization: Spread claims across multiple periods to manage tax impact

- Documentation: Track vesting start dates and claim amounts for accurate reporting

Summary

The Escrow system provides flexible management of your esXFI rewards:

Core Functions:

- ✅ Convert esXFI → XFI through linear vesting process

- ✅ Flexible claiming of unlocked XFI anytime

- ✅ Real-time tracking of vesting progress and metrics

- ✅ Strategic control over earning vs. liquidity balance

Key Benefits:

- ✅ Predictable liquidity through scheduled vesting

- ✅ Continued earning on unvested esXFI balance

- ✅ No penalties for claiming unlocked XFI

- ✅ Full transparency with comprehensive progress tracking

Use Escrow to create a "liquidity pipeline" — continuously vest portions of your esXFI to maintain steady access to liquid XFI while keeping the majority earning. This creates the perfect balance between yield optimization and practical usability! 🎯