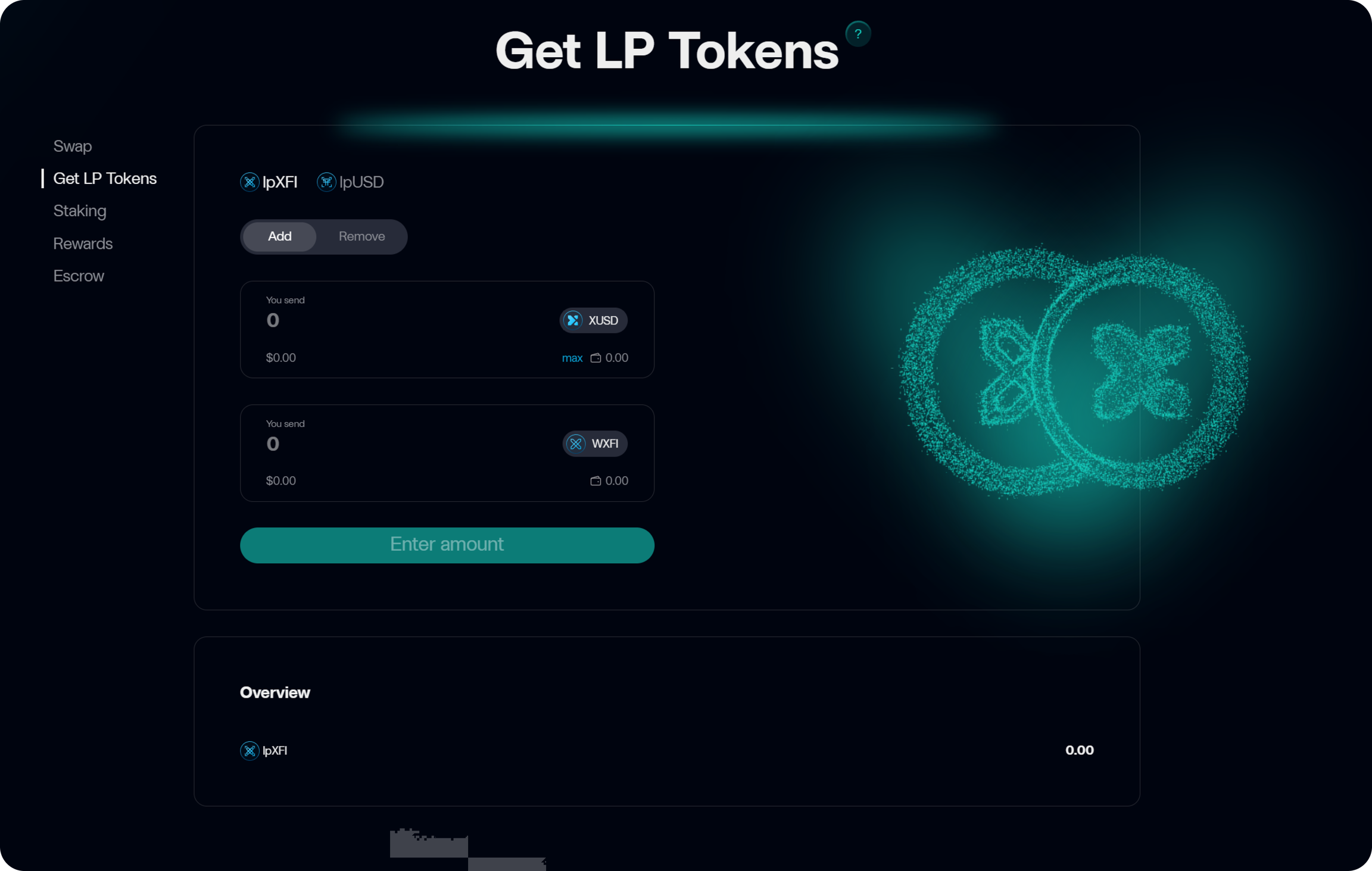

LP Tokens

Liquidity Provider Tokens (LP tokens) represent your share in a liquidity pool on the CrossFi decentralized exchange. By providing two tokens to a pool, you receive LP tokens, start earning trading fees, and gain access to additional rewards through staking.

CrossFi xApp LP Tokens - Earn fees and rewards through liquidity provision

CrossFi xApp LP Tokens - Earn fees and rewards through liquidity provision

Available Pools and LP Tokens

| Pool | Token Pair | What it Offers | Staking Rewards |

|---|---|---|---|

| lpXFI Pool | XFI / xUSD | • Main market of the network • High liquidity of XFI • Highest volume of trading fees | esXFI + WETH |

| lpUSD Pool | USDC / xUSD | • Two stablecoins — low volatility • Stable fee flow • Ideal for conservative strategies | esXFI + WETH |

In all pairs, the second token is xUSD — CrossFi's native stablecoin. It is issued with a 300% collateral in XFI and liquidated if the collateral falls to 200%.

Why Hold LP Tokens

💰 Pool Fees

Every swap incurs a 1% fee. Your share of these fees is automatically capitalized in the pool, increasing the LP token price.

🎁 Staking Rewards

When you stake LP tokens in the Staking section, you receive:

- esXFI — escrowed XFI, gradually becoming liquid XFI over time

- WETH — ETH from LayerZero bridge fees

- Bonus Points (BP) — loyalty points boosting your reward share

Reward Calculation Mechanics

The total pool reward in each distribution round is split proportionally by participant weight:

Where:

- LP — number of your LP tokens

- BP — bonus points. Earned continuously: +1 BP for every ~0.01 LP per day (~100 BP per 1 LP annually). Reset to 0 on unstake

- ST — amount of esXFI in your address; also boosts weight by compounding rewards

The higher your combined components relative to the total across all participants, the more XFI and ETH you earn.

How to Add Liquidity and Get LP Tokens

Prepare Assets

If you lack the correct token ratio, perform a swap first in the Swap section.

How to Remove Liquidity

- Go to LP Tokens → Remove Liquidity

- Select a pool, specify the number of LP tokens to burn

- Confirm the transaction — receive back your deposit + accumulated fees

How to Maximize Your Gains

| Strategy | Benefit |

|---|---|

| Long-term staking | BP accumulates over time, increasing weight — avoid interrupting stake |

| Reward compounding | Convert WETH to XFI/xUSD → increase LP → boost weight, BP, future esXFI |

| Monitor impermanent loss | Watch price of first token: strong fluctuations cause IL; rebalance as needed |

Mini-FAQ

| Вопрос | Ответ |

|---|---|

| Do I need to hold LP tokens for a full year to earn BP? | No. BP accrues every second proportionally. 100 BP ≈ 1 LP per year. |

| What happens to BP if I partially withdraw liquidity? | BP decreases proportionally to withdrawn share. Full withdrawal resets BP to 0. |

| Can I sell esXFI? | No, these are escrow tokens. They automatically convert into regular XFI on schedule as long as you remain staked. |

Summary

LP tokens are the foundation of DeFi income in CrossFi xApp. By providing liquidity and staking the resulting LP tokens, you receive:

- ✅ A constant stream of pool fees

- ✅ XFI rewards via esXFI

- ✅ ETH income in WETH

- ✅ Bonus points that amplify future rewards

The higher your contribution and the longer your participation, the bigger your share of the reward pie! 🥧