Rewards

The Rewards section in xApp is your earnings dashboard — it shows what you've accumulated in each pool and lets you Claim those tokens to your wallet. This is where all your staking efforts translate into real, claimable assets.

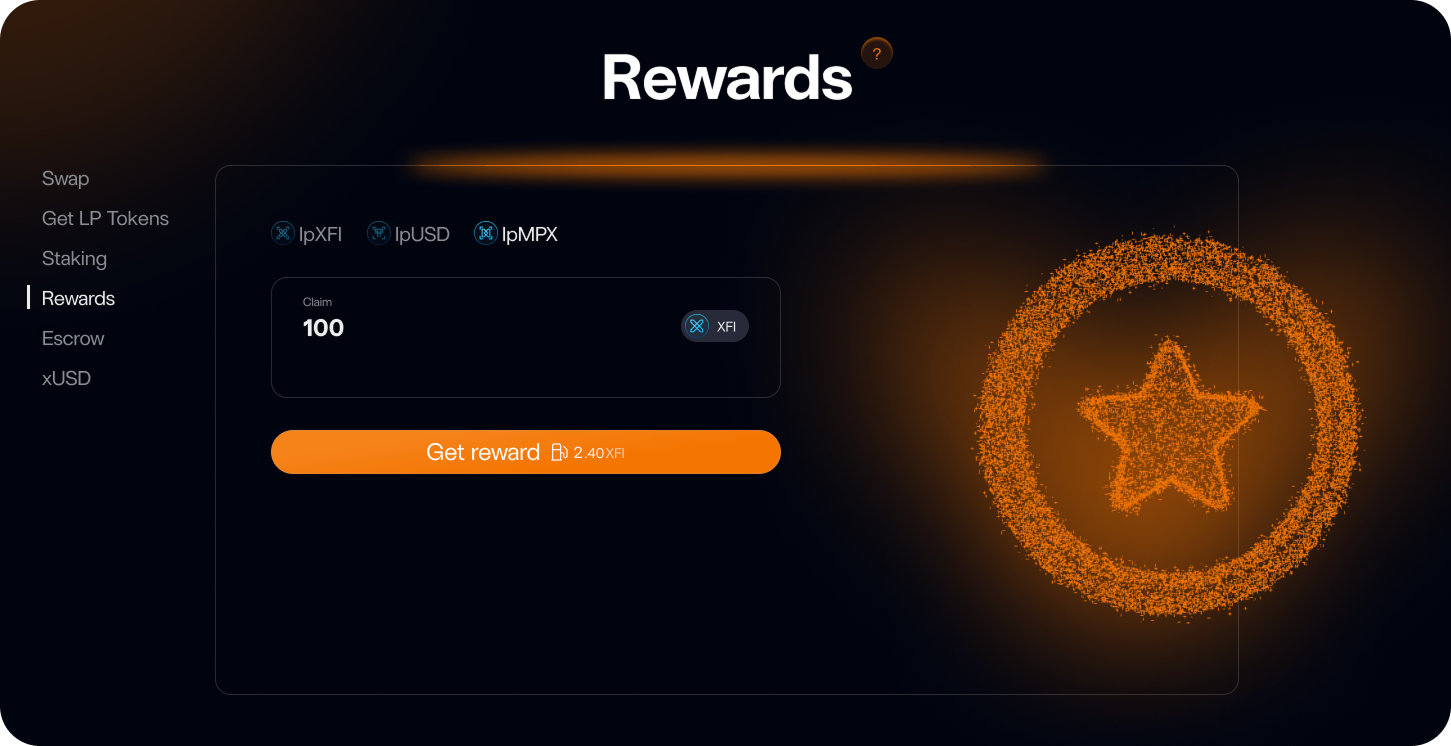

CrossFi xApp Rewards - Your earnings dashboard for claiming accumulated tokens

CrossFi xApp Rewards - Your earnings dashboard for claiming accumulated tokens

Pool-by-Pool Rewards Overview

| Pool | Claimable Token | How It's Earned |

|---|---|---|

| lpXFI | WETH | LayerZero bridge fees + swap fees (1%) → WETH |

| lpUSD | XFI | Foundation stake of MPX → esXFI → (auto-vests) XFI |

Bonus Points are an invisible, permanent loyalty metric that work behind the scenes:

- +100 BP ≈ 1 LP XFI staked for 1 year (100% APR boost on your LP)

- BP simply increase your share of every WETH & esXFI distribution

- BP never need to be claimed — they're automatically accounted for in calculations

Understanding Your Earnings

- 💎 WETH Rewards

- 🪙 XFI Rewards

- ⭐ Bonus Points

Earned from lpXFI staking. Sourced from LayerZero bridge operations and trading fees. Can be claimed anytime and used for compounding strategies.

Earned from lpUSD staking. Initially received as esXFI that automatically vests into liquid XFI over time. Check Escrow section for vesting details.

Accumulate continuously while staking. Cannot be claimed but permanently boost your share of all future reward distributions. Reset only on full unstaking.

How to View & Claim Rewards

Select Your Pool

Choose your pool at the top of the Rewards page (lpXFI or lpUSD) to view pool-specific earnings and available claims.

When you claim XFI from lpUSD rewards, it arrives as esXFI on your Escrow balance. Visit Escrow → Claim XFI to unlock (vest) it into liquid XFI over time.

Maximize Your Returns: The Compounding Loop

Smart users maximize their yield through strategic reinvestment:

WETH Compounding Strategy

- Claim WETH from lpXFI rewards

- Swap WETH for XFI + xUSD in equal proportions

- Add Liquidity to receive additional LP tokens

- Stake New LP to increase your position and future rewards

XFI Compounding Strategy

- Claim XFI (received as esXFI) from lpUSD rewards

- Vest in Escrow to unlock liquid XFI over time

- Use Unlocked XFI to add more liquidity or diversify into lpXFI

- Re-stake to compound your earning potential

Weekly Compounding Cycle: Claim → Swap → Add Liquidity → Stake → Repeat

This creates a powerful snowball effect where your rewards generate more rewards, exponentially growing your position over time.

Claiming Strategies by Goal

| Your Goal | Recommended Approach |

|---|---|

| Maximum Growth | Compound everything weekly; never withdraw to wallet |

| Steady Income | Claim monthly; withdraw 50%, reinvest 50% |

| Risk Management | Claim immediately; diversify into other assets |

| Long-term Hold | Let rewards accumulate; compound quarterly |

Frequently Asked Questions

| Question | Answer |

|---|---|

| Can I auto-claim my rewards? | No — each claim must be triggered manually so you maintain full control over gas costs and timing. |

| How often can I claim? | At any time with no minimum threshold. Frequent claims allow you to keep your WETH and vesting XFI actively working. |

| Do I need to claim Bonus Points? | No — BP are an internal weight multiplier and never withdrawable. They automatically boost your share of all distributions. |

| What happens to XFI if I unstake LP? | Your unvested esXFI continues vesting (at a slower rate). Fully vested XFI remain permanently in your wallet. |

| Where can I see vesting progress? | Check Escrow → Vesting Status or hover over tooltips in the Rewards section for detailed progress tracking. |

Reward Optimization Tips

Timing Your Claims

- Gas Efficiency: Claim during low network congestion periods

- Market Timing: Consider market conditions before converting WETH to other assets

- Batch Operations: Combine claims with other transactions to save gas

Maximizing Bonus Points

- Stay Staked: Never fully unstake unless absolutely necessary

- Partial Withdrawals: Use partial unstaking to access funds while preserving BP

- Long-term Mindset: BP accumulation accelerates over months and years

Cross-Pool Strategy

- Diversification: Split between lpXFI (volatile, higher yield) and lpUSD (stable, consistent)

- Risk Balance: Use lpUSD for stable base income, lpXFI for growth potential

- Rebalancing: Adjust allocation based on market conditions and personal risk tolerance

Summary

The Rewards section is your command center for DeFi income management:

Core Functions:

- ✅ lpXFI → Claim WETH (bridge fees + trading fees)

- ✅ lpUSD → Claim XFI (foundation staking rewards as esXFI)

- ✅ BP Management (automatic share boosting)

Best Practices:

- ✅ Manual claiming gives you complete control over timing and strategy

- ✅ Regular compounding through the Escrow system maximizes long-term growth

- ✅ Strategic reinvestment creates exponential wealth accumulation

Monitor your Rewards and Escrow sections regularly to extract maximum value from your staked LP positions. The combination of immediate WETH income and long-term XFI vesting creates a balanced, sustainable DeFi income stream! 💰