KYC Verification Guide

KYC (Know Your Customer) is a user identification procedure required to comply with international financial security standards. It ensures the authenticity of user identity and provides platform security.

This page contains a complete guide to the KYC verification process.

The verification process is mandatory for accessing virtual or physical cards. Without successfully completing all KYC stages, it will be impossible to obtain a card.

Verification Stages

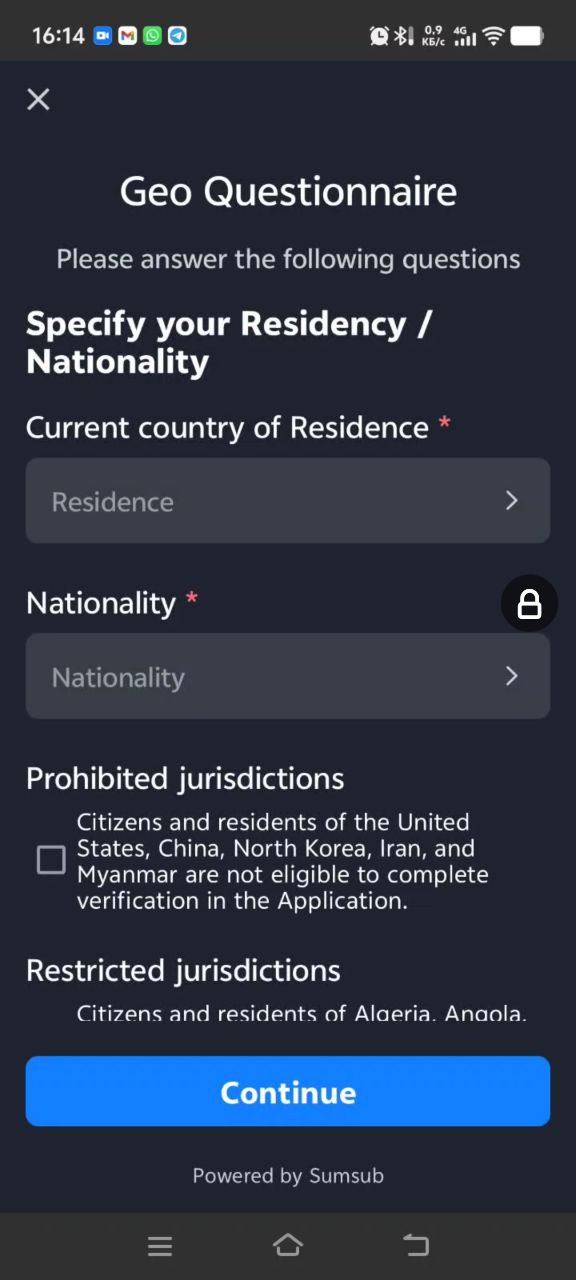

1. Geo Questionnaire

In the first stage, you specify your country of residence (where you actually live) and nationality.

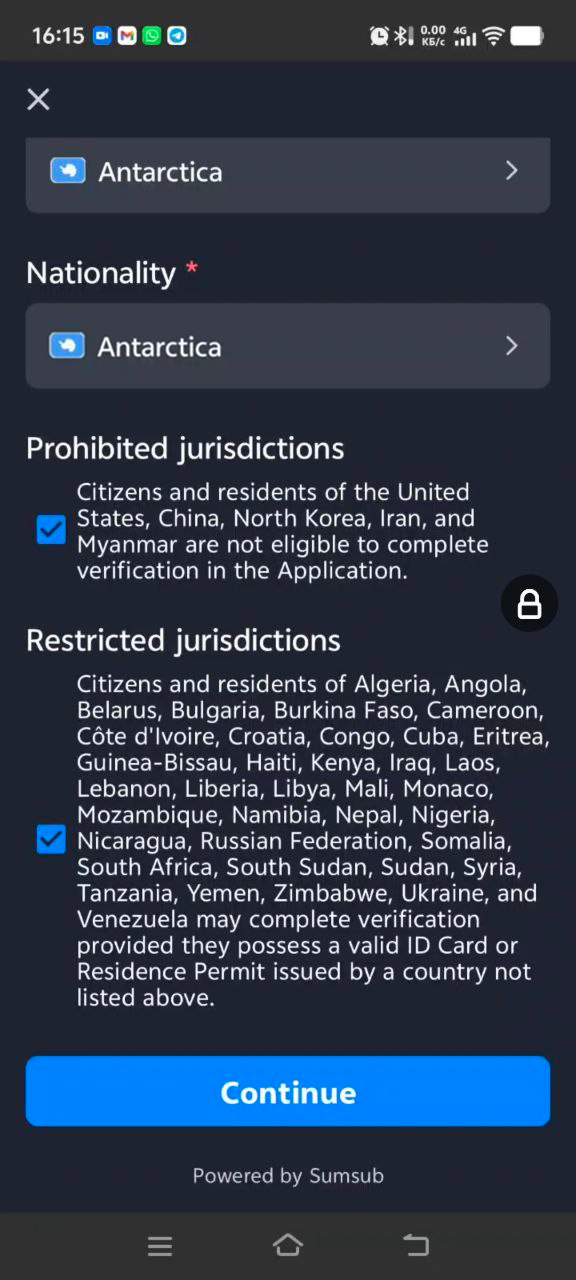

If you are a citizen of one of the completely banned countries — China, USA, Iran, Myanmar, or North Korea, you will not be able to pass verification, regardless of where you live.

If your nationality or residence is from a restricted country,the system will request an additional document at the identity verification stage. This includes a valid ID card or Residence Permit confirming that you reside in an allowed country.

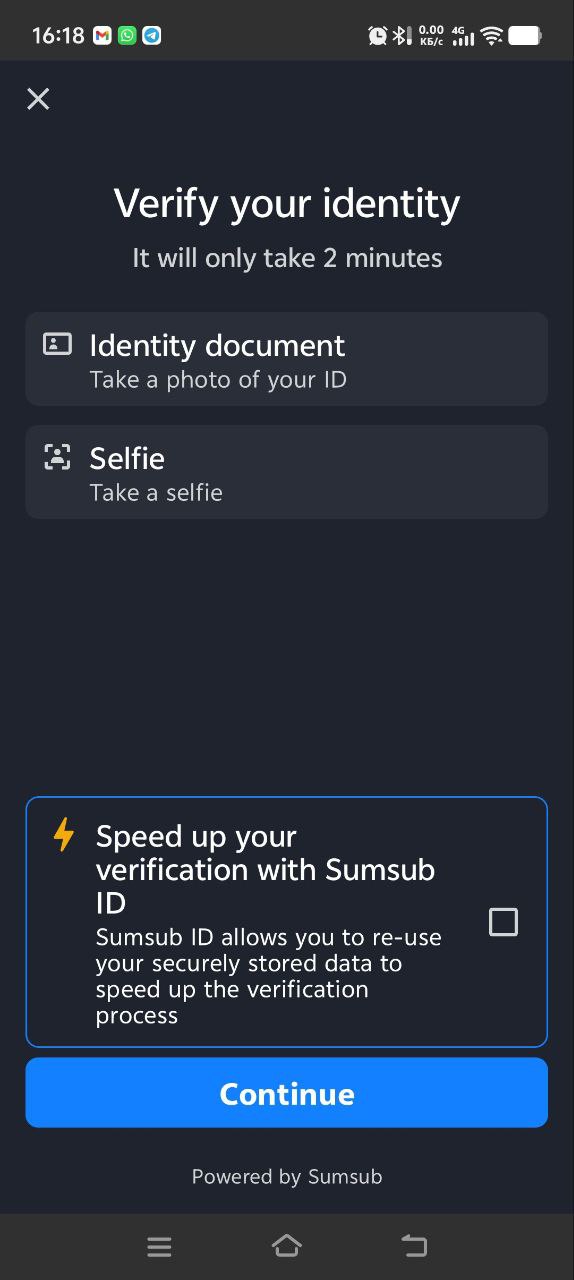

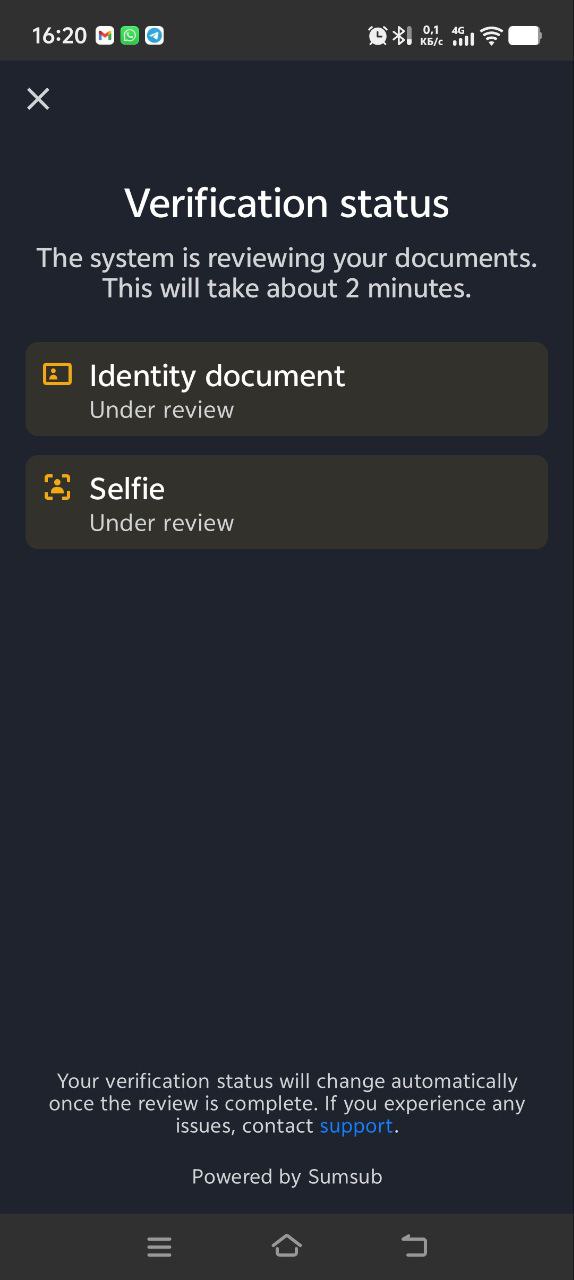

2. Proof of Identity Check (POI)

At this stage, you need to upload your passport or ID card.

Take a photo of the document through the Sumsub interface, then follow the instructions to complete photo verification (Selfie/Advanced Liveness Check).

If your document was issued by a restricted country, you will immediately be prompted to upload a second document confirming residency in a permitted country (such as a valid foreign ID or residence permit). This step is automatic and required to continue.

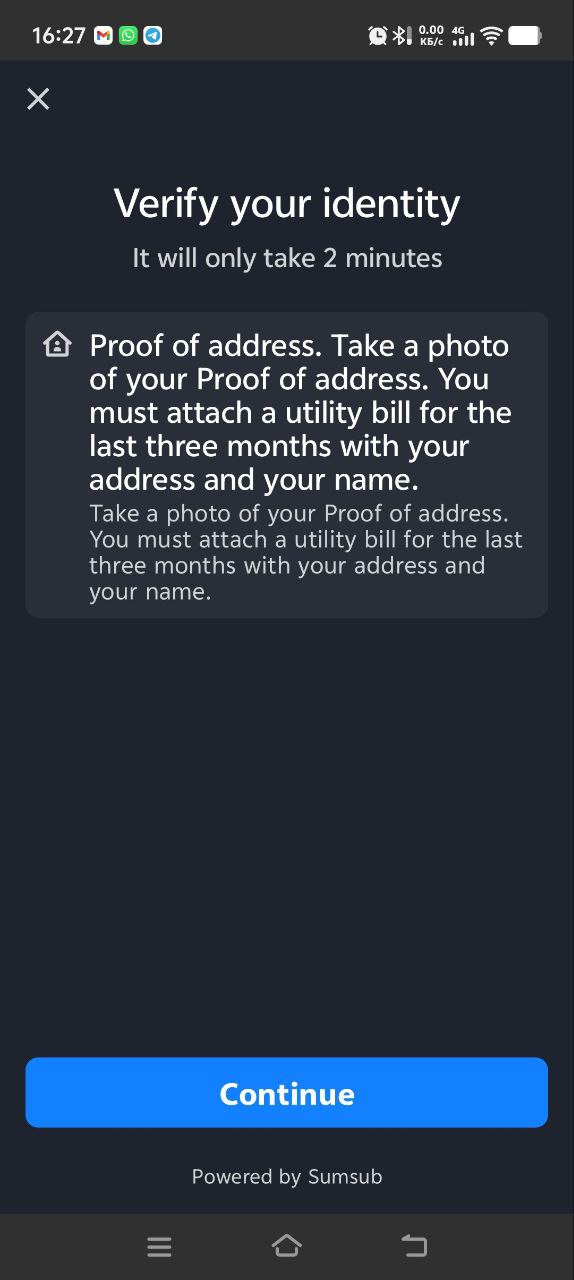

3. Proof of Address

At this stage, you must upload a document confirming your current residential address.

The document must:

- Be no older than 3 months

- Contain your full name, residential address (with country), and issue date

Most Convenient Option: ID card or residence permit that includes your address. For example, many Vietnamese ID cards display the full address.

Automatic Address Recognition: If your identity document (residence permit/permanent residence card, ID card, etc.) contains your address, the system will automatically recognize and accept it as proof of address - no additional documents needed!

Alternative Documents: The following are also accepted:

- Utility bills

- Bank statements

- Government documents

- Mobile operator bills

- Rental agreements

All documents must be readable and contain the necessary fields.

Errors often occur at this stage, especially if the document:

- Is older than 3 months

- Does not contain all necessary data (for example, the passport page with registration may not have the issue date)

- Is irrelevant (for example, a payment slip without a full address)

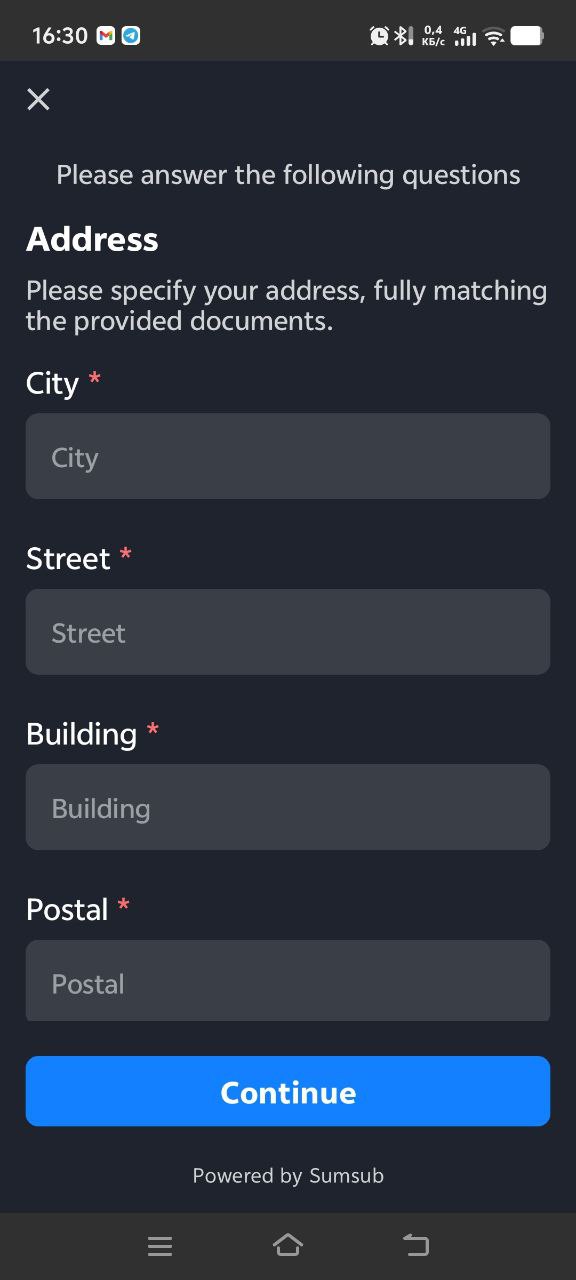

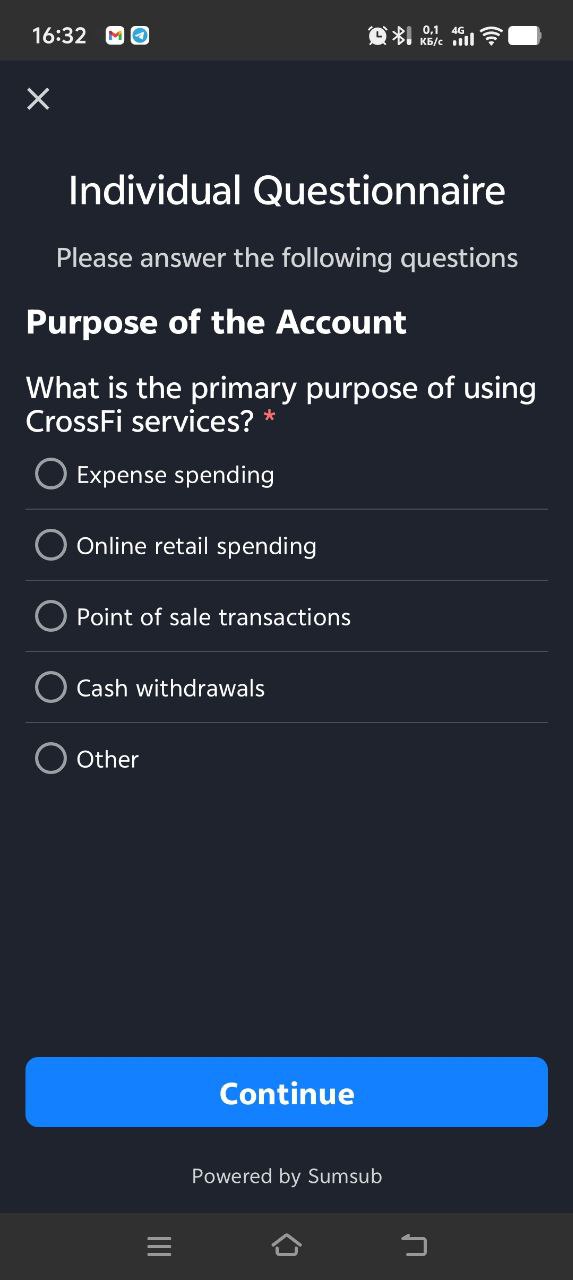

4. Individual Questionnaire

The final stage. First, you need to manually enter your residential address. It must completely match what is specified in the document. Any discrepancies (for example, in street or city names) may lead to additional verification.

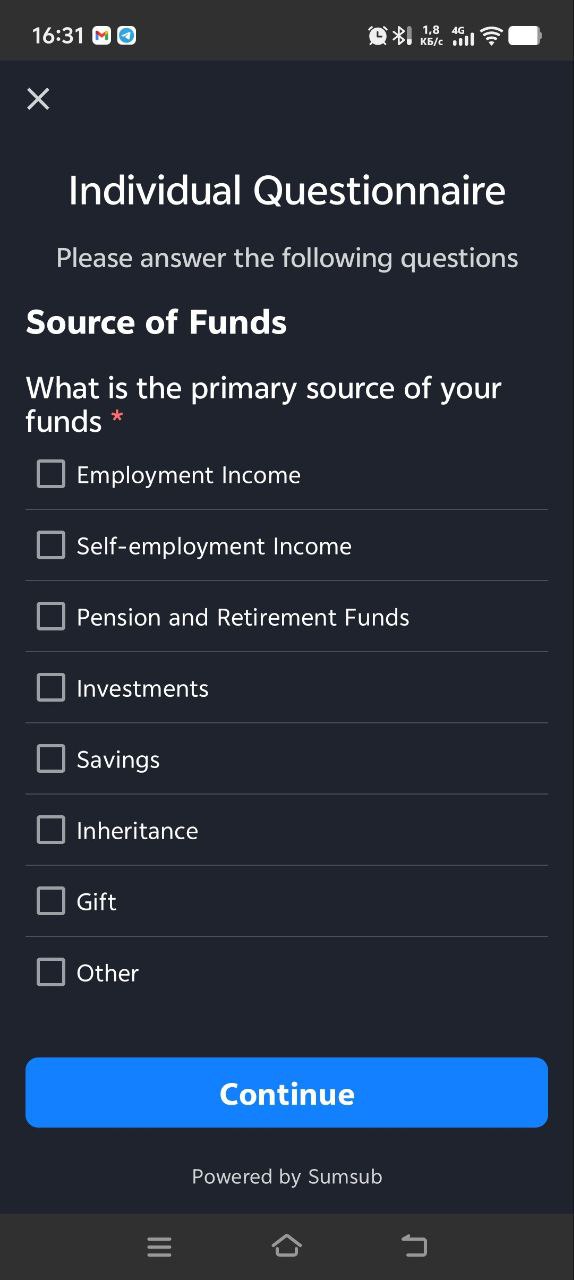

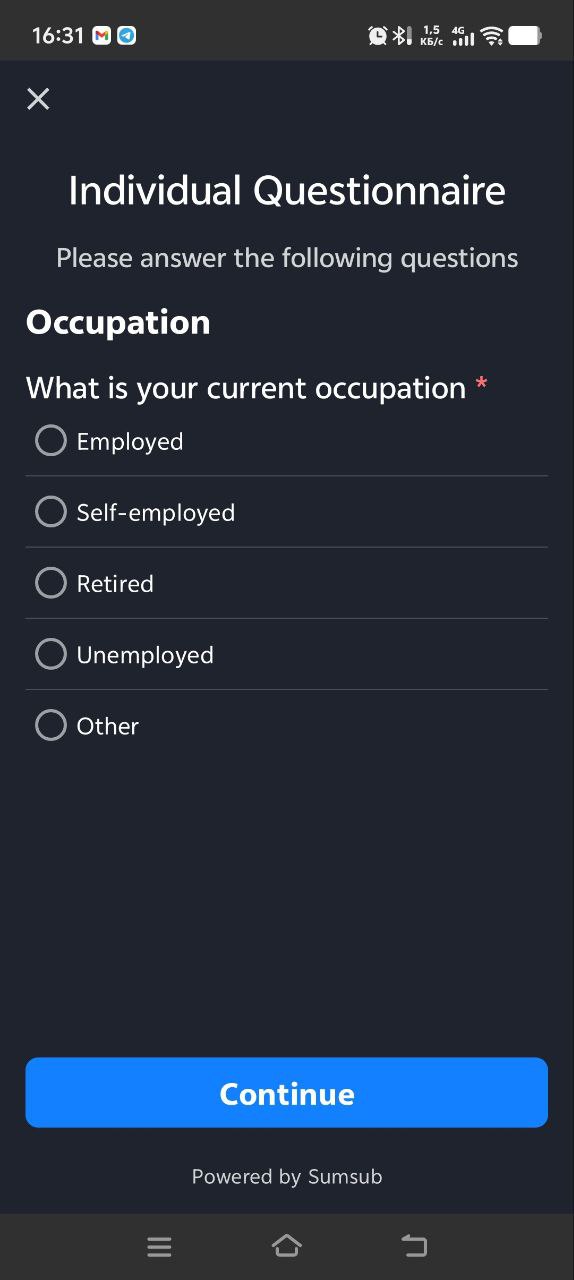

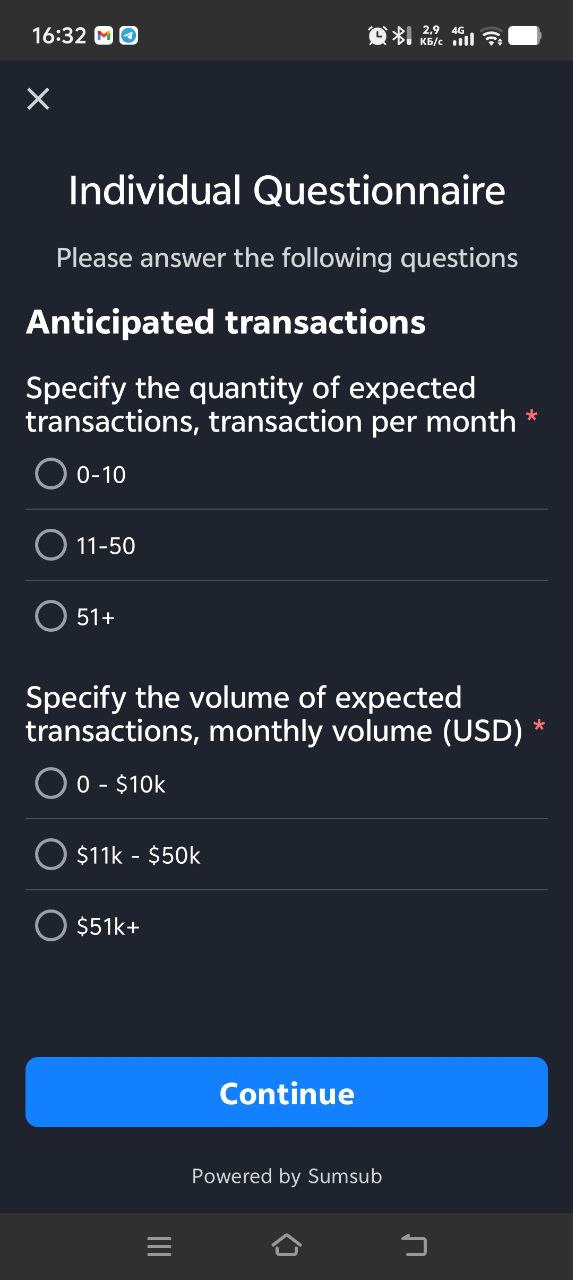

Then fill out a short questionnaire:

-

Employment Information: Specify your field of employment.

-

Transaction Volume: Indicate the planned transaction volume — approximate amounts and number of operations per month.

AML Check: The system automatically performs compliance checks. If any issues are detected, your application will be reviewed manually.

Country Restrictions

Completely Banned Countries

Citizens of these countries cannot pass verification regardless of their residency:

- 🇨🇳 China

- 🇺🇸 USA

- 🇮🇷 Iran

- 🇲🇲 Myanmar

- 🇰🇵 North Korea

Restricted Countries (Requiring Residency Proof)

Citizens of these countries are allowed to pass verification only if they provide a residence permit or ID card from another, unrestricted country. This additional verification happens during the Proof of Address stage.

View Complete List of Restricted Countries

Required Documents

Primary Identity Documents

📘 Passport

- Valid and not expired

- Clear, readable photo

- All information visible

🆔 ID Card

- Government-issued ID

- Both sides if applicable

- High-quality image

Additional Documents (If Required)

🏠 Proof of Address

- Document not older than 3 months

- Must include full name and address

- Issue date must be visible

📋 Residence Permit

- For restricted country citizens

- Valid residence document

- From unrestricted country

Verification Guidance

- Lighting: Ensure good lighting without shadows or glare.

- Quality: Use high-resolution camera mode.

- Stability: Keep the camera steady to avoid blurry images.

- Completeness: Ensure all document edges are visible in the frame.

- Validity: Check that all documents are current and not expired.

- Cleanliness: Ensure documents are clean and undamaged.

- Readability: All text must be clearly legible.

- Completeness: Include all required pages (both sides of ID cards).

- Document Expiry: Documents older than 3 months are often rejected.

- Missing Information: Ensure all required fields are filled and visible.

- Low-Quality Images: Blurry or low-resolution images can lead to rejection.

- Restricted Country Documents: Using documents from restricted countries without proper residency proof.

Steps to Resolve Issues

-

Review Rejection Reason

- Check the specific reason provided in the app notification or email.

-

Prepare Better Documents

- Ensure documents meet all requirements and are high quality.

- Use high-resolution camera settings and good lighting.

-

Resubmit Verification

- Start the verification process again with improved documentation.

Need Help?

Contact Support Options:

- 📧 Email Support: support@crossfi.com - For detailed verification assistance.

- 💬 In-App Chat: Available 24/7 in CrossFi App for immediate support.

Learn more about CrossFi App and card features:

Start Your Verification Today

Ready to unlock the full potential of CrossFi App? Complete your KYC verification and join the Web3 banking revolution with confidence and security.

Download CrossFi App

Get started with your KYC verification today

play.google.com